Brazilian nuclear utility Eletronuclear (part of state-owned power company Eletrobras) says it has finally received the results of a study on unit 3 of the Angra NPP prepared by the National Bank for Economic & Social Development (BNDES – Banco Nacional de Desenvolvimento Econômico e Social).

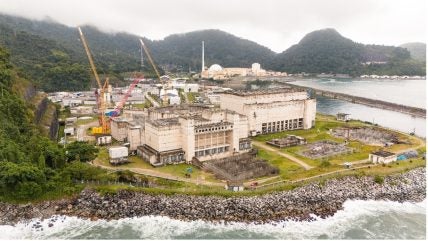

Angra NPP units 1&2 currently generate about 3% of Brazil’s electricity. Construction of Angra 3 with a Siemens/KWU 1,405 MWe pressurised water reactor began in 1984 but was suspended after two years. The project resumed in 2006 and first concrete was poured in 2010. But work stopped again in 2015 following allegations of corruption involving government contracts. The unit was then 65% complete.

In 2022, Eletronuclear ordered construction to restart but in April 2023 the city government of Angra dos Reis ordered work to stop again citing various issues including the promised payment of compensation. In March 2024, Eletronuclear launched a public consultation on completion of Angra 3, the results of which were published in August. The consultation was developed with technical support from BNDES and requested suggestions for improvements in documents related to Engineering, Purchasing & Construction Management (EPC) services, including the Risk Matrix and other contractual complements. It noted that the amount invested so far in Angra 3 is BRL7.8bn ($1.5bn) and to complete the plant a further BRL20bn will be needed.

The BNDES study looked into the technical, economic and legal feasibility of the project. It concluded that overall cost of abandonning Angra 3 may exceed BRL21bn while the cost to finalise the construction is estimated at around BRL23bn and the amount already invested in the work is almost BRL12bn. The plant is expected to enter commercial operation in 2031.

The study will be sent by Eletronuclear to the Ministry of Mines & Energy (MME) and shareholders (ENBPar and Eletrobras) and MME will then forward it to the National Energy Policy Council (CNPE – Conselho Nacional de Política Energética), which will decide whether or not to complete the plant.

The study proposes a tariff of BRL653.31 per MWh which Eletronuclear says is lower than the average cost of thermal plants in the region. “This is a crucial step for the continuity of the work and determination of the commercialisation tariff of the energy that will be generated by the plant. We are confident that the works will be launched soon and that the nuclear sector will once again be strong in Brazil”, said Eletronuclear President Raul Lycurgo.

“In summary, we have a competitive tariff proposal that will provide steady, reliable and clean energy to the system. But for those who still question this aspect, it is important to highlight that the costs 0of giving up Angra 3 are also not low,” he added.

The study also identified that about BRL800m worth of Angra 3 equipment had been used for Angra 2. Similarly, BRL500-600m worth of nuclear fuel was used by unit 2 that had been initially purchased for Angra 3. Therefore, approximately BRL1.4bn will be reimbursed by Angra 2 which will positively impact the tariff competitiveness of Angra 3.

The study broke down the cost of cancelling Angra 3 as follows:

- BRL9.2bn to pay off existing financing support from Caixa Econômica Federal and BNDES, including fines and penalties arising from non-completion of the work;

- BRL2.5bn for the termination of signed contracts and their respective penalties;

- BRL1.1bn for the return of tax incentives received in the importation and acquisition of equipment;

- BRL940m in demobilisation of works already carried out;

- BRL7.3bn opportunity cost of invested capital.

These amounts would have to be paid off in the short term, resulting in the further loss of almost BRL12bn.

The study noted that completion of Angra 3 would be financed by Eletronuclear itself with a consortium of banks. On the other hand, abandoning the project would require the state to bear the costs, which would ultimately be transferred to the electricity bill without consumers receiving energy in return.

Eletronuclear says Angra 3 will also play an important role in the diversification of the electric matrix and reduce the total costs of the National Interconnected System (SIN – Sistema Interligado Nacional), as it will replace the energy generated by thermal plants that have high generation costs. Moreover, NPPs do not emit greenhouse gases. For example Angra 1 & 2 together, generating 14.5bn kWh in a year, emit 174,000 tonnes of CO2 while a coal-fired plant with the same output emits 11.9m tonnes.

Another advantage is Angra’s proximity to the main consumption centres, which will help to minimise losses due to power transmission. Construction of the unit is also essential to rationalise the entire production chain of Brazil’s nuclear sector, from fuel production to power generation. The project will also create 7,000 direct jobs, at the peak of the work, in addition to even more indirect jobs.