China likely stands 10 to 15 years ahead of the United States in the development of Gen IV nuclear reactors. This is the conclusion of a new analysis from the science and technology think tank the Information Technology & Innovation Foundation (ITIF). Their latest report notes that China is rapidly moving forward with its nuclear buildout, aiming to install between 6 and 8 new nuclear reactors each year going forward and intending to build 150 new nuclear reactors between 2020 and 2035. That represents an additional 5-8 GW of new nuclear generating capacity a year and China already has 27 units currently under construction. This build rate is more than two and a half times that of any other country and the country is expected to surpass the United States in nuclear-generated electricity by 2030. China has an existing fleet of 56 reactors while the United States currently fields 94 units.

With an average construction timeline of about seven years for nearly every Chinese nuclear project that has entered service since 2010, since the start of 2022 China has completed an additional five domestic reactor builds. Completion times range from just under five years to just over seven years.

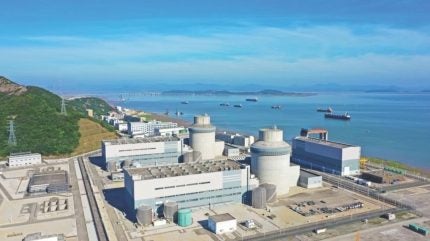

China has also already begun operating the world’s first fourth-generation nuclear reactor, the 200 MW gas-cooled Shidaowan-1 in Shandong province. In this regard, China asserts it developed some 90% of the technology of this unit. Furthermore, the report argues, China is also leading in the development and launch of cost-competitive small modular reactors (SMRs).

The core of Chinese nuclear innovation

The report acknowledges that these striking results do not necessarily mean that China’s largest nuclear power companies are exceptionally innovative technologically. Indeed, the bulk of China’s current fleet of nuclear reactors consists of Gen III reactors based on the Westinghouse Electric AP1000 technology that was transferred to China in 2008 as part of a contract to build four reactors.

The report notes that state-owned nuclear enterprise the China National Nuclear Power (CNNP) notes that “innovation and research and development (R&D) are not the primary emphasis of the company”. China’s Gen IV technology is not a new concept either. However, China has taken the steps to build and operate the technology. This is one of the key conclusions from the report. While noting that China’s nuclear industry is built on a base of foreign technology, it has rapidly advanced to become the world’s leading proponent, supported by a whole-of-government strategy that provides extensive financing and systemic coordination. Thus, where China has thrived in nuclear power its innovation is closely related to the country’s coherent national strategy toward nuclear power at both federal and provincial levels. The report notes this entails a range of supportive policies ranging from low-interest financing, feed-in tariffs, and other subsidies to streamlined permitting and regulatory approvals and effective coordination of supply chains. Rapid deployment of nuclear plants also produces significant economies of scale and learning-by-doing benefits.

The ITIF analysis emphasises China’s innovation strengths in organisational, systemic, and incremental innovation, noting that China’s state-backed approach excels at fielding nuclear technologies and making them a reality.

The Chinese government has prioritised domestic nuclear reactor construction as a key part of its energy strategy and is likely to use this as a foundation for competitive reactor exports. The report draws parallels with Beijing’s strategy for electric vehicles and batteries in this regard.

ITIF also suggests that Chinese nuclear enterprises will gain further incremental advantages given national policy has long prioritised both conventional and advanced reactor technology as a strategically important capability.

Although Chinese government approvals of new reactors slowed in the wake of the Fukushima Daiichi disaster the national commitment to nuclear power increased significantly with the 14th Five-Year Plan (2021-2025). Released in March 2021, it called for a buildout of 200 GW of nuclear capacity by 2035. By 2050, the report says, China wants nuclear to provide at least 15% of its total electricity generation. Although the nuclear contribution is expected to be less than that of wind and solar, nuclear energy will be crucial to meeting China’s goal of building a carbon neutral economy by mid-century. Economic and national security considerations also represent key nuclear drivers given China’s dependence on oil imports. The country seeks to replace all 2,990 of its coal-fired generators with clean energy solutions by 2060.

US should ape China’s approach to nuclear

The report highlights that while the United States remains the global leader in nuclear energy production with its 94 operating plants accounting for 31% of global nuclear power production, this represents almost entirely a previously fielded installed base. A fifth of US electricity and half of its clean energy is nuclear but only two nuclear power plants have been completed in the last decade.

This is in sharp contrast with China’s commitment to commercial nuclear power which has seen it nearly triple its nuclear capacity over the past decade. The report adds it took the US nearly 40 years to add the same nuclear power capacity as China achieved in the last 10 years.

Nuclear fusion represents another potentially transformative, disruptive nuclear energy innovation and in January 2024, the Chinese government launched a new national industrial consortium to promote the development and advancement of the technology. However, fusion technology remains very nascent and China and the US are probably on par with regard to technology development, according to the ITIF report. It says China is likely to adopt a fast-follower approach with regard to nuclear fusion and will probably seek to build an advantage when it comes to rapidly scaling deployment of fusion reactors. In this regard China’s demonstrated ability to deploy fission reactors at scale gives it a potential advantage when fusion comes online. Furthermore, the country already leads in the number of nuclear fusion patent applications.

ITIF argues that for the US to again become nuclear industry leader, it will need to ape China’s strategy and adopt a coherent “whole-of-government” approach. Among other steps, the report says, this would mean building sufficient human resources at federal R&D and regulatory agencies to support the innovation, down-selection, regulatory approval, and deployment of new reactor types. In addition, incentives, tax credits, or attractive financing options that facilitate the production of cost-competitive nuclear energy, and policies such as streamlined export credit programmes that support US nuclear exports are needed. The ITIF analysis suggests that, currently, civilian nuclear energy represents an industry in which the US has experienced a significant (and potentially permanent) loss of capabilities.

Follower or leader?

Concluding, the ITIF report states that the common narrative is that China is a copier and the United States the innovator. It warns that such a narrative often supports a lackadaisical attitude toward technology and industrial policy. The analysis also argues this assumption is misguided because it is possible for innovators to lose leadership to copiers with lower cost structures. This has been witnessed in many industries, including consumer electronics, semiconductors, solar panels, telecoms equipment, machine tools, quite possibly, nuclear power. It is also not clear that China is a sluggish copier and always destined to be a follower.

The basis of the ITIF conclusion comes from metrics like scientific publications on nuclear energy and nuclear energy-related patents. On both counts China is making significant strides, ranking first in the H-index metric measuring the scholarly impact of journal publications and recording a 13.4% share of all nuclear patents last year. In 2008 China’s share of all nuclear patents was 1.3%.

Ultimately the report cites Jacopo Buongiorno, a professor of nuclear science and engineering at the Massachusetts Institute of Technology (MIT), who observes: “China is the de facto world leader in nuclear technology.”