Fuel and fuel cycle

Aiming at export

2 July 2010Although South Korea makes nuclear fuel for domestic use, it has limited export capability as the fuel was designed in partnership with Westinghouse. KNF is now developing new third generation fuel, expected around 2017, in support of its plans to become an international vendor. By Kyu-Tae Kim

South Korea imported nuclear fuel in the 1970s and 1980s when nuclear power plants were first introduced. Then, it established a nuclear fuel localization programme through which first generation fuel was designed and manufactured.

South Korea started to develop an advanced (second generation) nuclear fuel from 1999, with Westinghouse, and succeeded in regional application of this advanced fuel from 2006. It is continuing to develop innovative nuclear fuels to upgrade nuclear reactor safety and economics as well as to secure exclusive ownership, which will enable it to sell fuel abroad.

NUCLEAR POWER PROGRAMME

Due to the limited amount of coal and hydro as indigenous energy sources, South Korea had to rely heavily on imported fossil fuels during its initial stage of economic development. However, oil shocks in the 1970s became a turning point for the country, leading to a change of South Korean energy policy from heavy dependence on oil to diversification of energy sources, including nuclear energy.

South Korea’s nuclear programme, launched in the 1970s, can be divided into three stages. The first stage consisted of three units constructed under turn-key contracts in 1970s, as domestic infrastructure was not matured. During this stage, foreign suppliers carried out all of the design, manufacturing and construction, which meant South Korea’s accumulation of nuclear technologies was very poor.

During the second stage – construction of six 900MWe-class units – the utility was in charge of project management, although design and manufacturing of the primary system was contracted to foreign suppliers. Under this approach, participation of the domestic industry was expanded and self-reliance in nuclear technology was further enhanced.

After the second stage, domestic industries participated in nuclear power programme as main contractors based on experiences gained through previous two stages.

At the end of 2009, South Korea had an installed nuclear capacity of 17.7GW, which accounted for almost 24% of the country’s total generation capacity. In 2009, nuclear power generation reached 147.8TWh, equivalent to around 34% of the country’s electricity generation.

Today sixteen PWRs and four PHWRs are in operation in South Korea. Eight more PWRs are due to be built by 2017, and another two by the start of 2020.

Eight of the operating PWRs are Westinghouse-type nuclear power plants (NPPs). They include one 14x14 NPP (Kori 1), one 16x16 NPP (Kori 2) and six 17x17 NPPs (Kori 3&4,Yonggwang 1&2 and Ulchin 1&2).

The other eight operating PWRs are 16x16 Optimized Power Reactors (OPR1000s), formerly known as Korea Standard Nuclear Plant (KSNP). They include Yonggwang 3,4,5&6 and Ulchin 3,4,5&6.

The PWRs to be built are four OPR1000s and six Advanced Power Reactors (APR1400s). The four OPR1000s are already under construction: Shin-Kori 1&2 and Shin-Wolsong 1&2. The units at Shin-Kori are expected online in December 2010 and December 2011, respectively. Two APR1400s, Shin-Kori 3&4 are also under construction and due to come online in September 2013 and 2014. Another two APR1400s are planned for Shin-Ulchin 1&2, and two more at Shin-Kori 5&6 are due to come online at the end of 2018 and 2019, respectively.

The operating conditions of the PWRs in South Korea are summarized in Table 1. The fuel design parameters including lattice parameters of the South Korean PWRs are shown in Table 2.

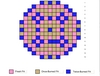

It should be noted that the fuel assembly used in the Westinghouse-type NPPs has eight spacer grids, 24 small guide thimble tubes and a top nozzle with leaf holddown springs, while the fuel assembly used in the OPR1000 has 11 spacer grids, four big guide thimble tubes and a top nozzle with coil-shaped holddown springs. The typical fuel-loading pattern employed in the OPR1000 is given in Figure 1.

NUCLEAR FUEL PROGRAMME

Nuclear fuel cycle costs account for 25-40% of the total power generation cost. Although the cost of nuclear fuel fabrication only amounts to around 10% of the fuel costs, the key to cost savings and efficiency enhancements in the entire nuclear fuel cycle lies in advancement of nuclear fuel technology.

If a country plans to supply its own fuel to nuclear power plants, it needs to secure a proven nuclear fuel design and manufacturing technology. This proven fuel technology can be developed through fuel component and materials design activities, manufacturing activities for out-of-pile tests, in-reactor verification activities, and nuclear fuel performance analysis and licensing activities. However, in order to set up a fuel fabrication programme, numerous manufacturing facilities, test facilities and performance analysis models and codes, etc., have to be developed, and it may take more than 20 years to set up this infrastructure.

South Korea decided to import nuclear fuel assemblies for Kori unit 1, which began operating in 1978, because the nuclear fuel technology localization was not economical for a few operating nuclear power plants. South Korea Nuclear Fuel (KNF) was established in 1982 to localize nuclear fuel technology, and the transfer process began in mid-1985. By the 1990s, eight PWRs were operating in South Korea and the government was determined to localize nuclear fuel design and manufacturing technology (although not fuel development technology). This was achieved via technology transfer from international fuel vendors, including Siemens/KWU, Combustion Engineering and Westinghouse Electric Company. The technology transferred was for first generation fuel, such as Vantage 5H (V5H) for Westinghouse PWRs and Guardian (GDN) for OPR1000 reactors.

However, world-leading fuel vendors continued to develop advanced nuclear fuels such as Areva’s AFA3G for French 17x17 Westinghouse PWRs, Areva’s (formerly?Siemens’) HTP for US 17x17 Westinghouse PWRs, Areva’s (formerly Siemens/KWU’s) FOCUS for German 16x16 Siemens PWRs, Westinghouse’s RFA for US 17x17 Westinghouse PWRs, Areva’s AGORA for 17x17 Westinghouse PWRs, and so on. In parallel, the nuclear industry has been developing innovative design concepts such as annular fuel, hydride fuel, nanofluids and ceramic cladding.

In order to become more competitive, in 1999 South Korea teamed up with Westinghouse to develop advanced nuclear fuels based on Westinghouse’s fuel development technology and out-of-pile test facilities. The second generation fuel developed in partnership with Westinghouse (PLUS7 and ACE7) meant that South Korean-made fuel became more competitive with respect to fuel reliability, high burnup capability and fuel economics. But unfortunately South Korea does not have the ownership of the second generation fuel and consequently its use is limited to South Korea.

So it is able to export nuclear fuel, South Korea has decided to develop its own (third generation) fuel technology, over which it will have exclusive ownership. This will give KNF the capability to sell advanced fuels for reactor projects abroad, for example the four reactor APR1400 project it was awarded in the UAE at the end of last year. The development of the third generation fuel (HIPER for OPR1000/APR1400 and X2-GEN for Westinghouse-type PWRs) is due to be completed by the end of 2016. The first reactor in the UAE is due to go online in May 2017.

Through its second and the third generation fuel development programmes, South Korea has established a nuclear fuel development procedure. It can be divided into six phases:

1. Conceptual design and screening

2. Preliminary design and economics/manufacturablity evaluation

3. Detailed design and drawing/specification generation

4. Out-of-pile verification

5. In-reactor verification

6. Licensing and commercial use

The history and design characteristics of the first, the second and third generation fuels, and South Korea’s future fuel development plans are described in more detail below.

FIRST GENERATION FUEL

Nuclear fuel design and manufacturing technology for Westinghouse-type PWRs was transferred from the former Siemens/KWU (to make the Korea Optimised Fuel Assembly, KOFA). The fuel design technology for the OPR1000 was transferred from the former Combustion Engineering, however it should be noted that the Siemens/KWU manufacturing technology was used for the OPR1000 fuel manufacturing.

After the technology transfer, South Korean-made fuels started to replace imported fuels such as Westinghouse’s Optimised Fuel Assembly (OFA), Standard Fuel Assembly (STD) and Robust Fuel Assembly (RFA) that had been used in the 14x14, 16x16 and 17x17 Westinghouse-type NPPs since 1989.

However, some fuel components such as fuel cladding, spacer grids, top and bottom nozzles still had to be imported. KNF began localization of fuel component manufacturing in the early 1990s. By the end of 2008, South Korea could domestically produce the components required for to manufacture nuclear fuel, with the exception of the Zr alloy TREX.

As of February 2010, KNF’s capabilities include: re-conversion of imported enriched UF6 to UO2 powder; fabrication of UO2 pellets; fabrication of cladding and guide tubes with imported TREX; fabrication of fuel rods and fuel assembly components such as spacer grid top and bottom nozzles; and manufacturing of fuel assemblies from fuel rods and fuel components fabricated by KNF.

The first generation fuel (Guardian) is susceptible to fuel failure such as grid-to-rod fretting, debris-induced fretting, excessive oxidation, etc. Its allowable burnup capability is limited to less than 45,000MWd/MTU (batch average). In addition, the first generation fuel can only be used in South Korea since its ownership and right for use beyond South Korea have not been secured. In other words, South Korea cannot export the first generation fuel and its technology without permission of the foreign fuel vendor with the fuel technology ownership.

SECOND GENERATION FUEL

Once they had transferred fuel technology to foreign countries, including South Korea, international fuel vendors such as Areva and Westinghouse developed advanced fuels such as AFA3G, HTP, TURBO, etc. These advanced fuel designs, with enhanced plant safety, reliability and economics, made South Korea’s localized fuel technology out of date.

The domestic fuel customer, South Korea Hydro Nuclear Power, asked the South Korean fuel vendor, KNF, to supply more advanced fuel in terms of the nuclear power plant safety, reliability and economics. Therefore, KNF established mid- and long-term nuclear fuel development programmes, and started an advanced nuclear fuel development programme in 1999. Based on the programme, KNF has developed advanced PWR fuel for the OPR1000 (PLUS7), and for the Westinghouse-type plants (ACE7).

However, it should be noted that the second generation fuel was based on Westinghouse fuel development technology and out-of-pile test facilities, since KNF did not have them when started its fuel development programme. Consequently, KNF has no ownership of the second generation fuel, and only limited usage rights beyond South Korea. So, even though KNF has become competitive with respect to fuel reliability, high burnup capability and fuel economics, it cannot compete on the international market.

PLUS7

KNF started to develop the PLUS7 fuel in 1999, and completed the design and out-of-pile verification tests by 2001. KNF carried out an in-reactor verification programme with four lead test assemblies (LTAs) from 2003 to 2007 at Ulchin 3. Based on the out-of-pile and in-reactor verification test results, the PLUS7 fuel has been licensed for regional use and has been commercially available since 2006.

The benefits of PLUS7 fuel compared with the first generation Guardian fuel are:

• An overpower margin increase of up to 13%

• Increase in burnup by up to 12%

• An electricity generation cost saving of about $1 million per plant

• Better seismic-resistance

• Improved fuel reliability against grid-to-rod fretting and debris-induced fretting

• Enhanced manufacturability

Table 3 shows the design differences between PLUS7 and Guardian.

ACE7

In parallel with the PLUS7 fuel development, in 2001, KNF started to develop the 16ACE7 and 17ACE7 fuels for the 16x16 and 17x17 Westinghouse-type NPPs, respectively. The fuel designs and out-of-pile verification tests were completed by 2004 at Kori 2&3. An in-reactor verification programme with four LTAs began in 2004, and ended in 2008. The 16ACE7 and 17ACE7 fuels have now been licensed for regional use and were commercially supplied from 2008 and 2009, respectively.

The benefits of the ACE7 fuel compared with first-generation fuel (V5H) are almost the same as those of the PLUS7 fuel mentioned above compared with first-generation fuel. The design parameters of 17ACE7 fuel are compared with those of its predecessor, V5H and its successor, X2-GEN in Table 4.

South Korea must have an advanced nuclear fuel with exclusive ownership in order to export nuclear fuel and its technology. Therefore, from 2005, KNF started to develop third generation fuel, over which it will have exclusive ownership. The third generation fuel is based on the fuel development technology and verification test facilities accumulated during the second generation fuel development.

THIRD GENERATION FUEL

The development of the third generation fuel can be divided into three phases. The activities of the first phase include fuel component concept design; screening tests; key design candidate selection; detail design of fuel components and fuel assembly; manufacturing technology development; out-of-pile verification tests; and final design.

The second phase covers LTA manufacture; LTA?loading in nuclear power plants; in-reactor verification tests with LTAs; poolside examination of LTAs and performance evaluations; and licensing for regional use.

Activities during the third phase will include the commercial supply of the fuel, surveillance of in-reactor performance and export of the fuel, if any.

Development of third generation fuel (HIPER) for the OPR1000 and APR1400 started in 2005, and is expected to be complete within ten years, by 2015. Development of X2-GEN, the third generation fuel for the 17x17 Westinghouse-type NPPs began in 2008 and is due to finish by 2016.

The design targets for the third generation fuel are an overpower margin increase of at least 5% compared with second generation fuel, increased burnup of up to 12%, improved fuel reliability (that is, improvement against grid-to-rod fretting and debris-induced fretting), and improvement of manufacturability.

All the out-of-pile test facilities except the critical heat flux (CHF) test facility have been set up at KNF and Korea Atomic Energy Research Institute (KAERI) during the second and third generation fuel development programmes. KNF is now verifying out-of-pile performance of the HIPER fuel, with the use of the fuel assembly and component test facilities at these two locations. KNF is also manufacturing Lead Test assemblies (LTAs) of the HIPER fuel to be loaded in one of the OPR1000s from 2011. The CHF tests will be performed in the near future at the CEA?research centre?in France.

PLANS FOR THE FUTURE

As of March 2010, second generation fuel is being commercially supplied to South Korean nuclear power plants. PLUS7 fuel is supplied to the OPR1000s, and 16ACE7 and 17ACE7 fuels are commercially supplied to the 16x16 and 17x17 Westinghouse-type NPPs, respectively.

KNF has already established a surveillance programme to evaluate the in-reactor performance of PLUS7 and ACE7, which will generate fuel degradation performance data in the high burnup range up to 75,000MWd/MTU. Based on these data, the high burnup fuel performance models and codes beyond the current licensed fuel rod burnup of 60,000MWd/MTU will be developed, verified and validated. They will then be submitted to the licensing organisation to expand the licensed burnup to about 75,000MWd/MTU.

KNF has completed the first phase of the HIPER fuel development that generated the final fuel designs. The second phase of the HIPER fuel development will be started from 2011 and completed by the end of 2016. During the second phase, the LTAs will be loaded and irradiated in one of OPR1000s until the end of 2016 to generate burnup-dependent fuel degradation performance data. The first phase of the X2-GEN fuel development is also underway.

In parallel with the LTA in-reactor verification tests in South Korea, KNF is expected to try to perform LTA in-reactor verification tests in foreign NPPs to speed up the export of the HIPER and/or X2-GEN fuel. This approach will likely be taken considering the length of time required for fuel qualification and licensing: at least 3 years for in-reactor verification and more than two years for licensing.

Another possibility for South Korea is the export of CANDU fuel. KNF is now supplying the standard CANDU fuel to the four PHWRs in South Korea (Wolsong 1-4) and may plan to export it to the PHWRs in Canada and China, based on its good operating experience.

Author Info:

Professor Kyu-Tae Kim, Dongguk University, College of Energy & Environment, 707 Seokjang-Dong, Gyeongju, Gyeongbuk, Republic of South Korea. Email: ktkim@dongguk.ac.kr. The author worked as project manager for the PLUS7 and HIPER fuel development at KNF from March 1999 through February 2009, after which he moved to Dongguk University. His recent work was supported by Nuclear Research & Development Program of National Research Foundation of Korea funded by the Ministry of Education, Science & Technology (Grant code: 2009-0075907).

Related ArticlesThe UAE reactor order – why is it so significant? First fuel gets loaded into Shin-Kori 1 0-1400MW in 10 years KEPCO and NPCIL ink cooperation agreement Fuel fabrication – outside of the fuel cycle? KEPCO takes a 10% stake in ImourarenTablesTable 1. Reactor operating conditions of PWRs in South Korea Table 2. PWR fuel assembly designs in South Korea Table 3. Comparison of fuels for OPR1000 and APR1000 Table 4. Comparison of fuels for Westinghouse type 17x17 NPPs