Fuel review | Conversion

New capacity needed

6 October 2010According to a high case demand forecast, current conversion capacity could begin to fall behind requirements as early as 2013, although the uncertainties of secondary supply play a crucial role. The costs of capacity expansion in conversion could nearly double current kgU prices. By Michael H. Schwartz and Julian Steyn

A succession of disruptions in the production of uranium concentrate (U3O8) to uranium hexafluoride (UF6) conversion services began in 2003 and continued through 2008 at the two North American conversion plants. This lead to (i) the heightened realization in 2004 that the nuclear fuel cycle is vulnerable to disruptions in the relatively low-cost conversion step; and (ii) the significant increase in the published long-term price for conversion services that occurred in that year.

In July 2003, the long-term market price for conversion services was reported by TradeTech as $5.20 and $6.50 per kilogram of uranium (kgU) for the North American and European markets, respectively. However, by August 2004 these prices had increased to $10.00 and $11.50 per kgU, respectively. During the next five years, 2005 through 2009, these prices held firm in fairly narrow ranges of $11.50 to $12.25 per kgU, and $13.00 to $13.50 per kgU, respectively, for the North American and European markets. As of 31 July 2010, the North American and European long-term market prices are reported by TradeTech as $11.50 and $13.00 per kgU, respectively. It is interesting to note that the almost two-year shut down of the Cameco Port Hope facility, 2007 – 2009, had no discernable impact on the published long-term market price for conversion services.

During the past several months, the spot market price for conversion services, which accounts for about 5% of the total value of natural UF6 (with the balance of its value being attributable to the uranium concentrates), has increased significantly, and is now within about 15% of the long-term market price.

Requirements

World requirements under the Energy Resources International reference nuclear power growth forecast for uranium in all forms—as UF6, uranium tetrafluoride (UF4) and uranium trioxide (UO3)—are projected to rise gradually from the present level of approximately 64,000 million tonnes uranium (MTU) to 102,000 MTU by 2030, an increase of 62.7%. Reference forecast world requirements for UF6 only are projected to follow the trend and rise gradually from 60,300 MTU today up to 98,000 MTU by 2030. World requirements for UF6 conversion services under the reference nuclear power growth forecast are also projected to increase by about 63% between 2010 and 2030. The increases during that period in the US and Western Europe are only expected to be 28% and 15%, respectively. However, the projected increases in requirements for UF6 conversion services in the Commonwealth of Independent States (CIS)/Eastern Europe, East Asia and other regions during the 2010 to 2030 period are expected to be 34%, 149% and 331%, respectively. Other regions include South America, Africa and the Middle East; India’s nuclear expansion has particularly driven growth in this region.

Secondary supply sources

Substantial secondary sources of UF6-equivalent (UF6e) material are currently available in the world. These secondary supplies could amount to more than 20,000 MTU per year between 2010 and 2013. Following the conclusion of the US-Russia HEU Agreement in 2013, these supplies are expected to fall to about 12000 MTU. However, it should be recognized that there are significant uncertainties in these forecasts, since they assume continuing availability to the commercial market.

Secondary supply sources include the natural uranium feed and conversion services equivalent of the Russian HEU; US Department of Energy HEU, natural uranium and high-assay tails; USEC disposable inventory, and the uranium resulting from underfeeding of the Paducah enrichment plant during the next few years; plutonium recycle and uranium recycle; and European and Russian tails that could be upgraded in Russia using that country’s surplus enrichment capacity. Although some materials such as uranyl nitrate (UNH) will not need to be converted to UF6, their supply will displace requirements for UF6. The Russian HEU feed also includes blending of small amounts of Russian HEU with European reprocessed uranium (RepU) through about 2025.

Substantial quantities of relatively high assay DOE enrichment tails in the form of UF6 could become a source of equivalent conversion services in the future, if economically worth upgrading. There are also believed to be substantial inventories of RepU at the U.K. and French reprocessing plants, some of which belong to customers of those plants, primarily Japanese electric utility companies. The DOE tails and the European RepU are not included in these numbers, except for the RepU blended with the Russian HEU for several Western European customers.

Primary supply

The world presently has four primary commercial suppliers of uranium conversion services, and each trades internationally. Areva/Comurhex is located in France; Cameco Corp is in Canada, with access to the output from a plant in the United Kingdom; ConverDyn is in the USA; and Rosatom is located in Russia with two plants.

Areva’s Malvesi plant produces UF4 and uranium metal. Its Pierrelatte facility produces UF6 from the UF4 produced at Malvesi or from UNH produced at the La Hague reprocessing plant. While Areva’s annual UF6 nameplate conversion capacity is 14,000 MTU, it reported producing only 11,000 MTU in 2008 and 13,000 MTU in 2009. There also is a 14,000 MTU per year uranium enrichment tails defluorination facility at Pierrelatte for the production of stable oxides that are suited to long-term interim storage or final disposal.

On 21 May 2007, Areva announced that it would build a new UF6 conversion complex at Malvesi and Pierrelatte, Comurhex 2. Areva announced that the new complex would be capable of converting 15,000 MTU per year beginning in 2012. It further noted that the complex could ramp up to 21,000 MTU per year depending on market conditions, which ERI interprets to mean both long-term commitments and acceptable long-term market prices. Site preparation was begun in mid 2007 and construction began in 2009.

France’s large domestic requirements allow Areva to maintain a significant base load capacity. It currently supplies approximately 28% of the world market.

Cameco Corporation produces both UF6 for LWRs and UO2 for CANDU reactors. Like Areva, Cameco utilizes the wet solvent extraction process with some new modifications allowing for recovery of hydrofluoric acid, which substantially reduces the volume of residue generated in UF6 conversion. Cameco operates a refining facility near Blind River, Ontario, which produces UO3 from U3O8. The annual capacity of this facility, which replaced an older and smaller facility in 1983, is 18,000 MTU in UO3. Most of the UO3 produced at Blind River is transported several hundred miles east across Ontario to Cameco’s conversion facility at Port Hope, which is about 60 miles from Toronto. Since March 2006, up to 5,000 MT UO3 per year is shipped annually to Springfields in the UK from there.

Westinghouse’s Springfields Fuels, Ltd. operates the fuel manufacturing facilities under a long-term arrangement on behalf of the U.K. Government’s Nuclear Decommissioning Authority (NDA). The deal includes a 6,000 MTU per year UF6 production plant located at Springfields, near Preston, Lancashire. Sustainable annual capacity is indicated to be about 5,000 MTU. The plant produces UF6 using the wet solvent extraction process to remove impurities from the incoming U3O8 concentrates.

Cameco recently stated that it had submitted a license application to increase the annual production at the Blind River Refinery from its present level of 18,000 kgU as UO3 up to 24,000 kgU of UO3. Not all of this additional UO3 capacity should be expected to go toward production of UF6; part of it would likely go into the production of UO2. Cameco’s overall nameplate capacity since 2006, including the Springfields addition, has been 18,500 MTU as UF6. Modifications to the location of fluorine cells that were made by Cameco during the past few years have optimized overall production efficiency in the main UF6 plant. The Port Hope conversion facilities include separate plants for UF6 and UO2 production. Cameco is the only commercial supplier of natural UO2 for the CANDU reactors operated in the Western world.

Cameco’s share of the world conversion services business in 2010 is estimated to be about 28%. Also, Cameco is one of the three Western companies that are marketing Russian HEU-derived UF6e under the Russian commercial marketing agreement.

ConverDyn is a partnership of General Atomic Energy Services (GAES) and Honeywell International, and has responsibility for selling the conversion services produced by the Honeywell Metropolis plant. It is the only conversion facility located in the US

In June 2007, ConverDyn reported that the annualized production capacity of the Honeywell Metropolis plant was 15,000 MTU as UF6 following expansion related process additions. This uprated figure coincided with its then stated new nameplate capacity of 17,600 MTU as UF6, which reflected an expansion of almost 20%. (Annual rating includes capacity reductions for maintenance and operational problems). However, this expansion was not actually completed and the nameplate capacity for the Metropolis plant is presently characterized as about 15,000 MTU. Moreover, ERI believes that Honeywell has been operating at production levels that are approximately 11,000 MTU per year and less during recent years.

On 28 June 2010, Honeywell locked out its union workers at the Metropolis plant over a labour dispute following expiration of a labour contract. After the lockout, the company was running the plant using trained and certified salaried employees and had plans to continue training a temporary, contingent work force; however, UF6 production was shut down. Honeywell issued a force majeure notice to ConverDyn; and ConverDyn in turn issued force majeure notices to its customers. [As of mid-August, the replacement staff were due to restart UF6 production in late August if NRC approval is received. Labour talks were due to restart on 10 August]. ConverDyn’s share of the world market in 2010 is estimated to be about 17%, and its share of the US market is estimated to be about 23%.

Rosatom produces UF6 at conversion plants operated by the Joint Stock Company (JSC) Angarsk Electrolysis Chemical and Combine (AECC) and the Siberian Chemical Combine (SCC) enrichment companies. These two entities receive UF4 feedstock from the JSC Chepetsk Mechanical Plant and uranium concentrates from domestic and foreign uranium mining enterprises. SCC also receives uranyl nitrate from uranium metal produced by Chepetsk that is processed at JSC Novosibirsk. The Chepetsk plant converts domestic, foreign, and inventory (from state reserves) uranium concentrates into UF4 and uranium metal. SCC also converts reprocessed uranium (RepU) under contract with Areva. The AECC also plans to construct a refinery at Angarsk.

Rosatom’s installed capacity has been routinely reported to be on the order of 25,000 MTU per year. But until Rosatom decides to make a major capital investment to upgrade and return its older equipment to operational status, current intelligence suggests that for purposes of estimating world conversion capacity, a sustained capacity of 11,000 is a more reasonable estimate. Actual production for 2008, 2009 and 2010 is estimated to be about 8,500 MTU. A substantial portion of the ‘conversion services’ it delivers is comprised of the natural uranium feed equivalent from downblended HEU.

At present, it is estimated that about 50% of Rosatom’s business is within Eastern Europe and the CIS, and that the balance of its portfolio is distributed fairly uniformly in the US, Western Europe and East Asia. Its share of the world market in 2010 is estimated to be about 22%.

Market outlook

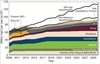

An analysis of the current and future relationship between supply and requirements in the market for conversion services has been performed consistent with the information provided above, and is displayed in Figure 1.

Between 2014 and 2020 there is effectively no margin between supply and requirements under the reference nuclear power growth forecast, which could become a problem if any of the presently operating facilities was unable to operate at its expected capacity. After 2020 supply is shown to be insufficient to meet requirements. Under the high nuclear power growth forecast, a supply deficit appears as early as 2013.

In order to meet such deficits in supply, it may be necessary to use lower enrichment tails assays, drawing down some portion of the existing strategic inventories being held by nuclear power plant operating companies, further expand existing conversion facilities, and build new conversion facilities. It should be noted that the lead time for a new plant is expected to be 3 to 5 years.

While present market prices may be adequate to support ongoing plant expansion activities for some of the primary suppliers, they are not sufficient for others and certainly not adequate to support construction of new conversion plants. Facility capital costs, financing, and an adequate return on investment will eventually require prices of as much as $15 per kgU as UF6, and possibly prices approaching $20 per kgU.

Author Info:

Michael H. Schwartz and Julian Steyn, Energy Resources International (ERI), 1015 18th Street NW, Suite 650, Washington DC 20036, USA