The European Commission (EC) has opened an in-depth investigation to assess whether the public support that Belgium plans to grant for the lifetime extension of two nuclear reactors (Doel NPP unit 4 and Tihange NPP unit 3) is in line with European Union (EU) state aid rules. The reactors are co-owned by Electrabel, a subsidiary of French energy utility Engie, with an 89.8% share, and Luminus, a subsidiary of EDF, with a 10.2% share.

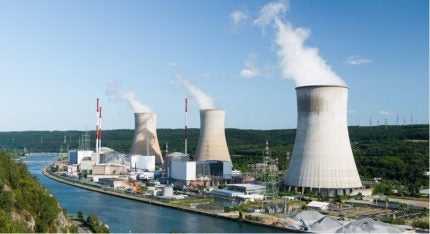

Belgium has seven nuclear power reactors – three at Tihange near Liege and four at Doel near Antwerp. All seven units are pressurised water reactors operated by Electrabel, part of Engie. Apart from Doel 1&2, which are 430 MWe plants, the others have a capacity of approximately 1000 MWe. Doel 3 was permanently shut down in September 2022 followed by Tihange 2 in January 2023 after 40 years of operation.

Nuclear power had long been a contentious issue in Belgium. After more than 20 years of debate, Belgium in 2020 decided to phase out nuclear power. However, in 2021, the authorities put forward two scenarios: plan A, to phase out nuclear power by 2025; and plan B to extend the life of two units for 10 years in the event of supply problems. Plan A was initially favoured but following the conflict in Ukraine and resulting energy shortages plan B was adopted in March 2022 with a decision to extend the lives of Tihange 3 and Doel 4 until 2035. The two reactors have been in service since 1985.

Belgium and Engie in July 2022 signed a “non-binding letter of intent” concerning the life extension of Doel 4 and Tihange 3 followed by a formal agreement in January 2023 initiating the immediate start of environmental and technical studies. In June 2023 Belgium’s Federal Agency for Nuclear Control (FANC – Federaal Agentschap voor Nucleaire Controle) and Engie Electrabel concluded an agreement on the extension and in July FANC submitted its expectations regarding nuclear safety to Engie Electrabel.

An analysis by grid operator Elia had shown that an energy shortage could occur as early as the winter of 2025-2026, which could only be met with nuclear capacity. At the request of the government, FANC proposed the necessary amendments to the Royal Decree on the safety regulations for nuclear installations to allow extension of Doel 4 and Tihange 3. “The necessary safety improvements may be spread over time and must all be implemented by 2028. In this way it is also possible to use Doel 4 and Tihange 3 in the winter 2025-2026,” FANC said.

Belgium notified the EC of its extension plans for Doel 4 and Tihange 3 for 10 years. EC noted that Belgium plans to support the extension through a partnership with Engie, which includes the following components:

- Financial and structural arrangements including: (i) the creation of a 50-50 joint-venture between the Belgian State and Electrabel which would own, together with Luminus, the plants and their production; (ii) shareholder loans and an equity injection by the Belgian State and Electrabel for a total amount of around €2bn ($2.2bn) to cover the necessary capital expenditure; and (iii) financial support mechanisms provided by the Belgian State, including the prefunding of Electrabel’s costs and expenses, a contract-for-difference (CfD) for the duration of the extension, a loan of approximately €580m and an operating cashflow guarantee.

- Transfer of liabilities from Electrabel to the Belgian State concerning long-term storage and final disposal of nuclear waste and used fuel, against the payment of €15bn; and

- Risk-sharing and legal protections in the event of future legislative changes, specifically concerning nuclear operators in Belgium or Electrabel’s nuclear activities.

The EC said it considers that these components should be examined together as one single intervention and involve State aid. “While the Belgian measure appears justified, at this stage, the Commission has doubts as to its compatibility with EU State aid rules and has therefore decided to open an in-depth investigation.”

In particular, the EC will further investigate:

- The necessity of the additional financial support mechanisms on top of the CfD, in particular the creation of the joint-venture and its financing, as well as of the operating cashflow guarantee and the €580m loan;

- The appropriateness of the CfD design and the combination of financial and structural arrangements as they may unduly relieve the beneficiaries from too big a share of the market and operational risks;

- The proportionality of the combination of financial and structural arrangements and of the €15bn lump sum;

- Compliance with relevant EU sectoral legislation, in particular concerning the design of the CfD mechanism; and

- The impact of the measure on the market in light of the CfD design and the selection and independence of the agent selling the nuclear electricity.

The EC noted that the opening of the in-depth investigation gives Belgium and interested third parties an opportunity to submit comments and does not prejudge the outcome of the investigation.