US law firm Pomerantz LLP is investigating claims on behalf of investors of NuScale Power Corporation. The investigation concerns whether NuScale and certain of its officers and/or directors have engaged in securities fraud or other unlawful business practices, Pomerantz said.

On 29 July, Hunterbrook Media reported that “the US Securities and Exchange Commission’s (SEC’s) Division of Enforcement is conducting an ‘active and ongoing’ investigation into NuScale”, citing “SEC’s July 24 response to an open records request obtained by Hunterbrook.” Although the SEC’s response to Hunterbrook’s request did not provide details regarding the subject of its investigation, Hunterbrook’s report noted that “the US Nuclear Regulatory Commission raised significant questions about NuScale’s risk mitigation plans for one of its reactor designs”. It further asserted that “after a decade and a half of research and development, NuScale has yet to commercialise any reactors”.

On this news, NuScale’s stock price fell $1.35 per share, or 12.44%, to close at $9.50 per share on 29 July.

Pomerantz LLP, with offices in New York, Chicago, Los Angeles, London, Paris, and Tel Aviv, is a leading firm in the areas of corporate, securities, and antitrust class litigation. Pomerantz was founded by the late Abraham L Pomerantz, known as the dean of the class action bar, and has pioneered the field of securities class actions. On its website, with reference to the NuScale Power Corporation Securities Class Action, it asks interested parties: “Please submit the form below if you believe you have incurred losses…. Please share any additional information you’d like us to know about your situation (e.g., the number of shares you purchased, purchase dates, any shares you sold).”

NuScale is also being investigated by US law firm Hagens Berman Sobol Shapiro LLP, which describes itself as “a global plaintiffs’ rights complex litigation law firm focusing on corporate accountability through class-action law”.

Earlier in August, Hagens Berman urged NuScale investors “who suffered substantial losses” to submit your losses now. “The firm also encourages persons with knowledge who may be able to assist in the investigation to contact its attorneys.”

Referring to the Hunterbrook Media report that the SEC was conducting an “active and ongoing” investigation into NuScale Hagens Berman noted that a NuScale spokesman had said in a statement that the company was “unaware of any SEC investigation into NuScale or any reason for such an investigation”.

However, “on August 2, 2024, NuScale did an about face,” Hagens Berman said. “The company admitted that, contrary to its July 29 denial, in December 2023 the SEC requested information relating to the company’s employment, severance, and confidentiality agreements. In addition, NuScale revealed that the SEC requested additional information from the company on July 31, 2024.”

Each of these events sharply drove down the price of NuScale shares. “We’re investigating the propriety of NuScale’s financial disclosures and operations, including whether the company’s agreements with employees suppress whistleblowing,” said Reed Kathrein, the Hagens Berman partner leading the investigation.

“If you invested in NuScale Power and have substantial losses, or have knowledge that may assist the firm’s investigation, submit your losses now,” Hagens Berman said.

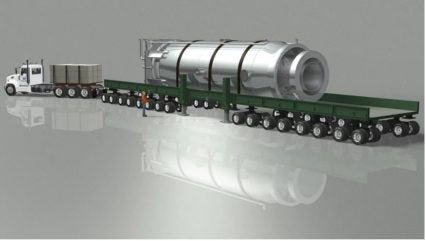

However, NuScale CEO John Hopkins expressed optimism announcing the second quarter results. “As the only SMR certified by the US Nuclear Regulatory Commission, NuScale is uniquely prepared to deliver in a customer environment intensely focused on near-term deployment of carbon free power,” he said. “We continue to advance conversations with potential customers around the world as we progress the manufacturing of our advanced SMR technology.”

Actions taken by NuScale to reduce operating costs and improve efficiency, including an approximate 28% reduction in its workforce earlier this year, had helped the company trim operating losses in Q2 2024, the company said. NuScale reported an operating loss of $41.9 million in the quarter ending June 30, down from an operating loss of $56.1 million in Q2 2023.

However, project complexity and risk aversion among potential offtakers had affected NuScale’s efforts to close revenue-generating customer agreements, Hopkins said during a subsequent conference call.

He reiterated on the call that NuScale’s technology is the only SMR to receive design certification from the US Nuclear Regulatory Commission. Although the NRC’s 2023 certification was based on an earlier 50 MWe version of NuScale’s VOYGR reactor, the company’s application for NRC approval of a 77 MWe version is on track to conclude by mid-2025, Hopkins said.

Until November 2023, NuScale appeared to be leading the field to deploy the first small modular reactor (SMR) in the USA. Utah Associated Municipal Power Systems (UAMPS) and NuScale Power had agreed to construction of six small modular reactors (SMRs) at the US Department of Energy’s (DOE’s) Idaho National Laboratory (INL) as part of the Carbon Free Power Project (CFPP). However, the project was cancelled. “Despite significant efforts by both parties to advance the CFPP, it appears unlikely that the project will have enough subscription to continue toward deployment,” a joint statement said. In January 2024, NuScale had to lay off 28% of its workforce and NuScale’s stock price subsequently fell by more than 8% as investors sold off shares.

Following the cancellation of the 462 MWe Carbon Free Power Project, NuScale’s most advanced project is an effort to build a 462-MW nuclear generation facility on the site of a former coal-fired power plant in Romania, Hopkins said in the conference call. That project is proceeding now into an approximately 12-month engineering and design phase, after which the Romanian government could approve general construction, he added.

Hopkins was optimistic about the US ADVANCE Act signed into law in July that expands NRC cooperation with international partners on regulation, development and export of advanced nuclear reactor technologies and directs the DOE to improve its nuclear technology export approval process, according to law firm Sidley Austin. This could also support NuScale’s domestic activities by streamlining coal-to-nuclear conversions, Hopkins said.

The Department of Energy’s upcoming SMR solicitation is another significant domestic opportunity for NuScale, he added. The solicitation has two stages. It includes up to $800m in “first mover team support” for up to two teams of “utility, reactor vendor, constructor, and end-users or power off-takers committed to deploying a first plant while at the same time facilitating a multi-reactor, Gen III+ SMR orderbook,” and $100m in “fast follower deployment support” for awardees committed to addressing bottlenecks in design, licensing, supply chains and site preparation.

“We believe NuScale is well-positioned for consideration to be a recipient or a recipient partner under both of these awards,” Hopkins said. The DOE is expected to announce final award selections in mid-2025.

NuScale officials on the call did not discuss the ongoing investigation by the SEC into the company’s employment, confidentiality and severance agreements.